Advertisement|Remove ads.

Nippon Life India Is Set For A Fresh Bull Run: SEBI RA Aditya Thukral Eyes ₹950 Target In 6-8 Weeks

Nippon Life India Asset Management could rally by over 18% in the medium term, following its recent breakout from a cup pattern on strong volumes, noted SEBI-registered analyst Aditya Thukral.

Since the breakout, Nippon Life AMC stock has consolidated within the ₹735 – ₹800 range, with gradually declining volumes, a typical sign of accumulation. However, the stock is beginning to push past the upper end of this range, likely signaling the start of a fresh bull run, Thukral said.

A conservative price target of ₹950 can be expected over the next six to eight weeks, an 18% upside to the current stock price, he added.

At the time of writing, the stock was trading slightly lower at ₹803.00.

The technical structure remains robust, with the stock forming higher highs and higher lows across all time frames, confirming both short- and long-term uptrends, he added.

The stock is trading comfortably above its 50-day, 100-day, and 200-day exponential moving averages (EMAs). At the same time, the RSI remains stable near 60 on both daily and weekly charts, indicating sustained momentum and potential for further upside.

This breakout appears to be the early phase of a potential fresh bull run in the stock, with the cup pattern serving as a strong bullish base. Thukral recommends taking up positions around ₹807, with a weekly closing stop-loss at ₹712, which marks the higher low of the ongoing rally.

He also noted that their price target remained unchanged despite the stock going ex-dividend (₹10 dividend) on July 4.

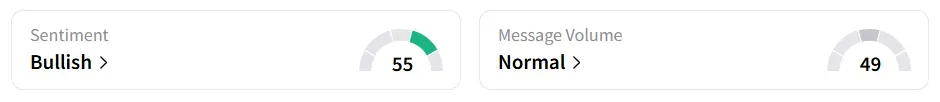

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a week ago.

Year-to-date, Nippon Life India Asset Management shares have gained 10.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_neww_a4e4f5f75e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_psychedelics_brain_resized_b52324b5d5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1496337898_jpg_8e75bdf43f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243968069_jpg_3ccb34d8bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_jpg_bfd8288cf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_unh_stock_resized_jpg_e69fd915e3.webp)